Navigating Global Trade Certification for Best Hydraulic Pressure Reducing Valve Procurement

In the evolving landscape of global trade, the procurement of Hydraulic Pressure Reducing Valves is increasingly influenced by technological advancements and regulatory challenges. According to a recent report by MarketsandMarkets, the hydraulic valves market is projected to reach $10.67 billion by 2025, highlighting a compound annual growth rate (CAGR) of 4.7% from 2020. This growth is driven by the rising demand for automation in various industries and the push for energy-efficient solutions. However, navigating the certification process for these essential components can pose significant challenges for procurement professionals. With emerging alternatives and rapid technological changes on the horizon, understanding the best practices in acquiring Hydraulic Pressure Reducing Valves becomes paramount for industry players who aim to stay competitive and compliant.

Key Regulatory Standards for Hydraulic Pressure Reducing Valve Certification Globally

When procuring hydraulic pressure reducing valves, understanding key regulatory standards for certification is essential for ensuring product reliability and safety across global markets. Manufacturers must navigate various international standards, including ISO (International Organization for Standardization) and ANSI (American National Standards Institute) guidelines. Compliance with these standards not only facilitates smoother trade but also enhances product competitiveness by satisfying the quality criteria expected by industry stakeholders.

In addition to ISO and ANSI, regions such as the European Union require adherence to CE marking regulations, which signify compliance with safety and health standards. Furthermore, manufacturers must consider additional certifications specific to different countries, such as UL (Underwriters Laboratories) in North America or CSA (Canadian Standards Association) in Canada. By aligning with these key regulatory standards, companies can minimize risks associated with non-compliance while ensuring that their hydraulic pressure reducing valves meet the necessary performance criteria for various applications around the globe.

Impact of Global Trade Agreements on Hydraulic Valve Procurement Processes

The landscape of hydraulic valve procurement is significantly influenced by global trade agreements, such as the recent UK-New Zealand Free Trade Agreement. These agreements aim to strengthen bilateral trade, with projections indicating an increase of up to £1.7 billion in commerce over time. Such economic shifts create opportunities for companies engaging in hydraulic pressure reducing valve procurement, as they can benefit from reduced tariffs and streamlined regulatory processes, fostering a more conducive environment for sourcing materials and components.

Moreover, the disruptions witnessed in global supply chains over the past four years have emphasized the necessity for firms to prioritize resilience alongside efficiency. With industrial manufacturing facing substantial challenges, organizations must adapt their procurement strategies to ensure an uninterrupted supply of hydraulic valves. Emphasizing a diversified supply base can mitigate risks associated with dependency on single-source suppliers, leading to more robust procurement processes. As global trade dynamics continue to evolve, the ability to navigate these changes will be pivotal for companies seeking to optimize their operations.

Essential Quality Metrics in Selecting Hydraulic Pressure Reducing Valves

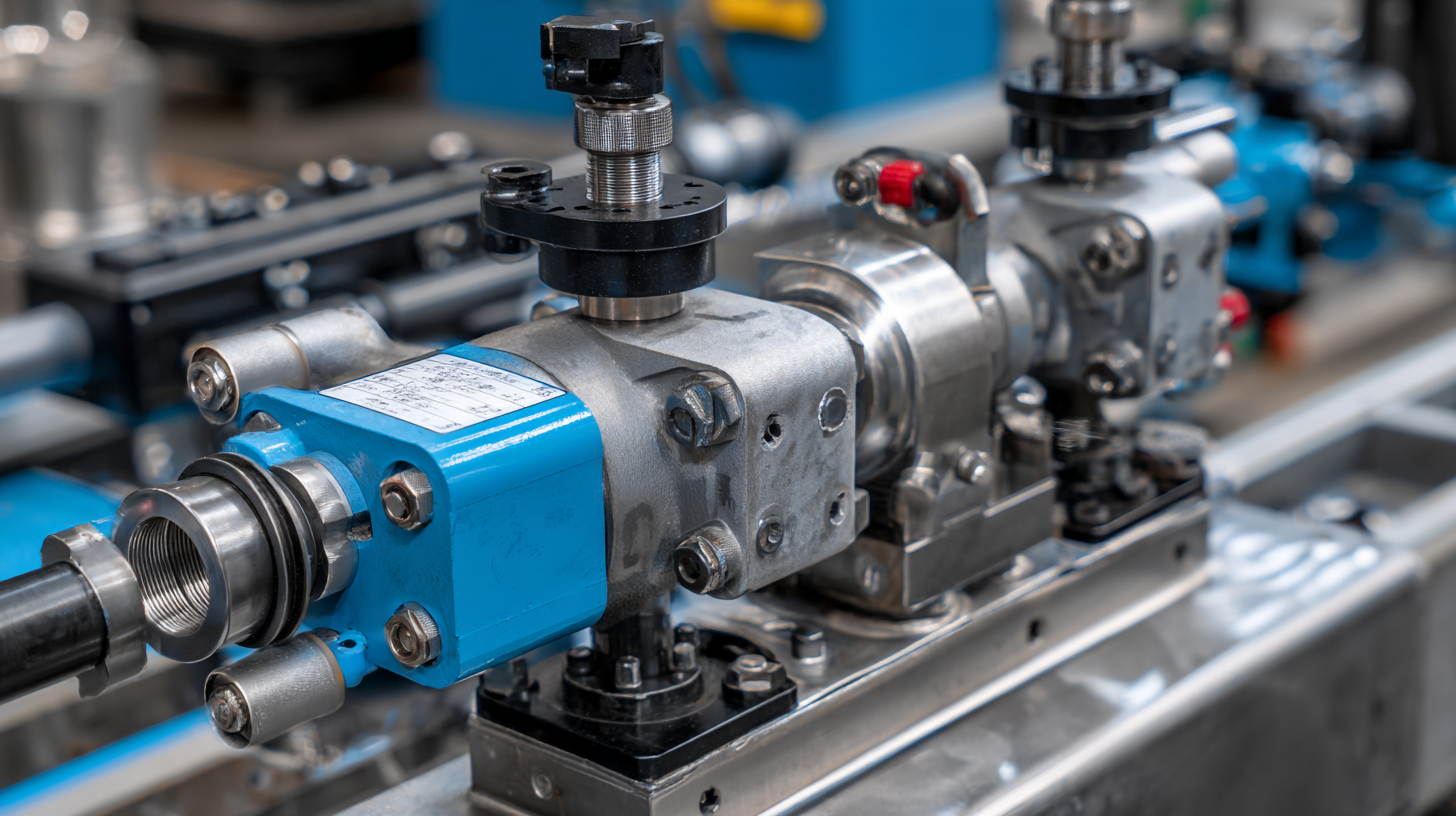

When selecting hydraulic pressure reducing valves, understanding essential quality metrics is crucial for ensuring optimal performance and reliability. First and foremost, it's vital to assess the valve's pressure rating and flow capacity. These specifications dictate whether the valve can withstand operational pressures while effectively regulating flow rates in the system. Additionally, materials used in construction significantly influence durability and resistance to corrosion, which are critical for maintaining efficiency in diverse environments.

Another key quality metric is the valve's response time and adjustability. An ideal hydraulic pressure reducing valve should provide quick adjustments to pressure changes, ensuring that systems function smoothly without delays. Furthermore, precision in pressure regulation is essential; even minor fluctuations can lead to significant operational issues in hydraulic systems. Evaluating the manufacturer’s certifications and industry standards compliance will ensure the valve not only meets but exceeds the benchmarks set for quality and safety, leading to better procurement decisions.

Navigating Global Trade Certification for Best Hydraulic Pressure Reducing Valve Procurement - Essential Quality Metrics in Selecting Hydraulic Pressure Reducing Valves

| Metric | Description | Importance Level | Standard Value |

|---|---|---|---|

| Pressure Rating | Maximum allowable pressure the valve can handle. | High | Up to 5000 PSI |

| Flow Coefficient (Cv) | Measure of the flow capacity of the valve. | Medium | 1 to 100 |

| Material Compatibility | Compatibility of valve materials with hydraulic fluids. | High | Steel, Brass, Aluminum |

| Temperature Range | Operating temperature limits of the valve. | Medium | -20°C to 80°C |

| Certification | Industry certifications for safety and quality standards. | High | ISO, CE, ANSI |

| Warranty Period | Duration for which the valve is covered under warranty. | Medium | 1 to 5 years |

Comparative Analysis of Leading Manufacturers in Hydraulic Pressure Regulation

In the dynamic landscape of global trade, the procurement of hydraulic pressure reducing valves plays a crucial role, particularly within the expanding automotive hydraulic system market, projected to grow from $47.43 billion in 2023 to $57.80 billion by 2030, at a compound annual growth rate (CAGR) of 2.9%. Understanding the leading manufacturers in hydraulic pressure regulation involves a comparative analysis of their capabilities, product quality, and compliance with global certification standards, which are essential for ensuring safety and reliability in automotive applications.

Tip: When evaluating manufacturers, consider their track record in certifications, as compliance with international standards can significantly impact the longevity and performance of hydraulic systems in varying conditions.

Furthermore, optimizing energy consumption and performance in hydraulic systems is increasingly important as the industry aims for sustainable practices. Recent studies suggest that innovative approaches, like incorporating modern control techniques, can lead to significant improvements in energy efficiency. Manufacturers are adopting advanced technologies to enhance the functionality of hydraulic systems, setting benchmarks in energy management.

Tip: Engage with suppliers who demonstrate a commitment to sustainable practices, as this not only aids in compliance with regulations but also aligns your procurement strategy with environmental stewardship goals.

Navigating Global Trade Certification for Best Hydraulic Pressure Reducing Valve Procurement

Trends and Innovations Shaping the Future of Hydraulic Pressure Reducing Valves

The future of hydraulic pressure reducing valves is being significantly shaped by advancements in technology and emerging market trends. With the integration of AI-powered operational intelligence, companies are achieving unprecedented efficiency in managing hydraulic systems. These innovations not only enhance performance but also contribute to sustainable practices in design and operation. For instance, the focus on energy efficiency has led to the development of low-pollutant machines in off-road hydraulics, which aim to eliminate flow throttling in control valves, improving overall system efficacy. By 2025, industry reports suggest a growing need for these energy-efficient systems as end-users prioritize environmental impact alongside functionality.

Moreover, the global landscape of hydraulic systems is being influenced by important trends in water management. As water scarcity becomes a pressing issue, companies are investing in cutting-edge technologies such as advanced desalination methods and wastewater processing. Startups are driving innovation with solutions that not only ensure efficient water use but also incorporate sustainable practices, creating a ripple effect throughout the hydraulic sector.

As we look towards 2025, these transformations in hydraulic pressures and water management will be crucial in meeting both regulatory standards and market demands, paving the way for a more resilient infrastructure.